The bitcoin derivative was born as a result to meet the need of investors who are looking to achieve optimal performance by capitalizing on potentially large price movements that were very common on bitcoin. For example, if you have 1 bitcoin on binance, you can borrow up to 2 bitcoins more and trade as if you had 3 bitcoins.

Reasons to Bitcoin's Volatility Could Be The Rising

Reasons to Bitcoin's Volatility Could Be The Rising

Thus, you provide $10 000 of your own funds and borrow $40 000.

Margin trading bitcoin. A small drop in price results in a big loss. Unlike most currencies, which are backed by governments or other legal entities, or by commodities such as gold or silver, bitcoin and ethereum and any other virtual currency are unique and. One click, and you are ready!

In many cases, you can control 10 to 20 times the amount required to open the position. Get your hands on all the tools and test the platform in the simulated environment that reflects the market conditions. The price of bitcoin goes up, and now it reaches $15,000.

Primarily, the terms relate to whether a trader believes that bitcoin will rise or fall in the future. When you “go long,” you believe that the bitcoin price will rise over time. Bitcoin margin trading has become increasingly available for crypto enthusiasts over recent years.

For example, if we opened a bitcoin margin position with a 2x leverage and bitcoin had increased by 10%, then our position would have yielded 20% because of the 2x leverage. Whitebit exchange offers a margin trading terminal, smart staking and many other features and advantages. Bitcoin and ethereum and any other virtual currency trading also has special risks not shared with official currencies or goods or commodities in a market.

You sell those 3 bitcoins for $45,000. Basically, this advanced strategy enables them to borrow additional funds and open larger trades. With margin trading you can, for a theoretical example, buy $10,000 worth of bitcoin with only $5,000 (borrowing 50% aka leveraging 2:1 or 2x).

8 disadvantage of bitcoin margin trading trading on margin is highly risky and the cryptocurrency market takes the risks to a new level. Another benefit of margin trading cryptocurrencies with kraken is that we offer extremely competitive fees. Margin trading, also known as leveraged trading, is a form of trading that uses borrowed funds in order to trade larger amounts of a specific asset.

Now, you open a long position with 3 bitcoins. Practice margin trading with the instant demo account for free! The leverage will be 1:3, which means you will be borrowing $20,000.

Nicolas tang date:december 23, 2020 as cryptocurrency has been growing around the world, exchanges dedicated to trading these currencies have been booming and creating a separate market from the traditional forex market for these trades. You have $10,000 and would like to try margin trading. Make sure to know your skills and your limits exactly, bitcoin margin trading is especially risky and in volatile markets like all crypto currency markets.

Trade bitcoin spot, long or short on margin, btc futures, bitcoin options & cfd's. So, you could engage in leverage trading. While margin trading increases your profits when successful, it also accelerates your loses when unsuccessful.

Powering bitcoin trades since 2014. The used margin represents the total amount of margin, which is tied to all your active. From the outset our vision was that the margin trading terminal should be powerful, robust and easy to use.

For example, peter has $100 in his account, he can open a buy or sell $1,000 worth of position via leverage. It is also referred to as a ”good faith deposit”. The initial margin refers to the amount of funds you deposit with a brokerage in order to begin trading on margin.

The amount put down to open a trade in bitcoin leverage trading is known as margin. Bitcoin margin trading for us traders. Bitcoin margin trading comes with “short” and “long” positions—which is popular with traditional stock trading.

We show you what bitcoin margin trading is & what the best exchanges are. On this page you can find all the bitcoin exchanges and trading platforms which allow margin trading. Find the best bitcoin trading platforms.

Access to our crypto margin trading price data and btc margin trading price data to plan your trading strategies. Bitcoin margin trading, in simple words, allows opening a trading position with leverage, by borrowing funds from the exchange. Depending on the currency pair you’re looking to leverage, we’ll only charge up to 0.02% to open a position and up to 0.02% (per 4 hours) in rollover fees to keep it open.

As a us american trader you can really get frustrated when looking for a cyptocurrency margin broker. Our development team has done an awesome job of realizing this vision and has worked tirelessly to build a platform that enhances your bitcoin and cryptocurrency trading experience. Bitcoin leverage trading allows you to control more sizable positions and make more profits.

The risk increase with the leverage taken, high leverage means more risk. But margin trading bitcoin is a really easy way to lose money trading bitcoin. Bitcoin margin trading with leverage is a high risk/high reward trading technique.

L everage allows traders to potentially buy or sell any trading instruments that are larger than their deposit amount. The price of bitcoin at the moment is exactly $10,000. Okex offers bitcoin and crypto margin trading services.

Bitcoin margin trading gives users a chance to test their skills and patience. Primexbt has scintillated the margin trading for millions of crypto enthusiasts and is one of the crypto exchanges that allow shorting bitcoin like cryptocurrencies on high leverage. This value, when combined with our deep liquidity across all of our markets, means that you’ll be able to.

Traditional margin trading and bitcoin margin trading are similar in process. Trade bitcoin markets with up to 100x leverage. Bitcoin margin trading on phemex author:

XBT/USD Analysis Is 7,200 Bottom Bitcoin Has Been

XBT/USD Analysis Is 7,200 Bottom Bitcoin Has Been

Análisis XBT / USD señas de ruptura de cuña descendente

Análisis XBT / USD señas de ruptura de cuña descendente

Can Bitcoin Defend Channel Support And Push Above 7.5k

Can Bitcoin Defend Channel Support And Push Above 7.5k

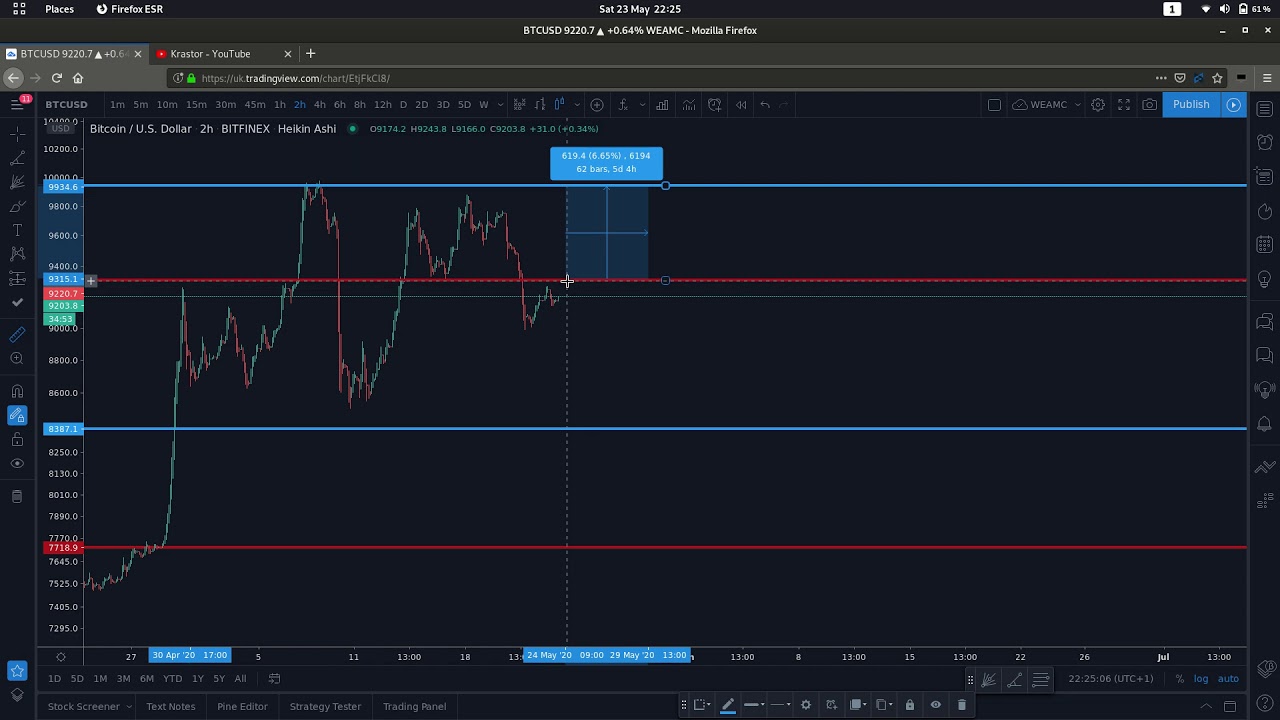

Bitcoin Margin Trading Ideas 23 May 2020 YouTube

Bitcoin Margin Trading Ideas 23 May 2020 YouTube

How to hedge Bitcoin risks with margin trading

How to hedge Bitcoin risks with margin trading

비트코인 실전매매로 보여드립니다. 실전매매 최강자 마블입니다. bitcoin margin trading

비트코인 실전매매로 보여드립니다. 실전매매 최강자 마블입니다. bitcoin margin trading

Bitcoin Margin Trading Ideas 12 June 2020 YouTube

Bitcoin Margin Trading Ideas 12 June 2020 YouTube

6,400 Beckons As Bitcoin Forms A Choppy Rectangle Pattern

6,400 Beckons As Bitcoin Forms A Choppy Rectangle Pattern

Bitcoin Margin Trading Ideas 24 May 2020 YouTube

Bitcoin Margin Trading Ideas 24 May 2020 YouTube

How to hedge Bitcoin risks with margin trading

How to hedge Bitcoin risks with margin trading

Análisis XBT / USD los comerciantes largos de Bitcoin dan

Análisis XBT / USD los comerciantes largos de Bitcoin dan

Análisis XBT / USD inversión de patrón de cuña

Análisis XBT / USD inversión de patrón de cuña

Bitcoin Margin Trading Ideas 26 May 2020 YouTube

Bitcoin Margin Trading Ideas 26 May 2020 YouTube

Margin Trading Bitcoin My Setup

Margin Trading Bitcoin My Setup

Análisis XBT / USD ¿Posible recuperación de Bitcoin a

Análisis XBT / USD ¿Posible recuperación de Bitcoin a

Análisis XBT / USD Bitcoin se prepara para la ruptura del

Análisis XBT / USD Bitcoin se prepara para la ruptura del

Margin Trading Bitcoin Bitmex Ethereum Mining Rate Chart

Margin trading with Bitcoin SV, 3 other cryptos now

Margin trading with Bitcoin SV, 3 other cryptos now

0 Comments